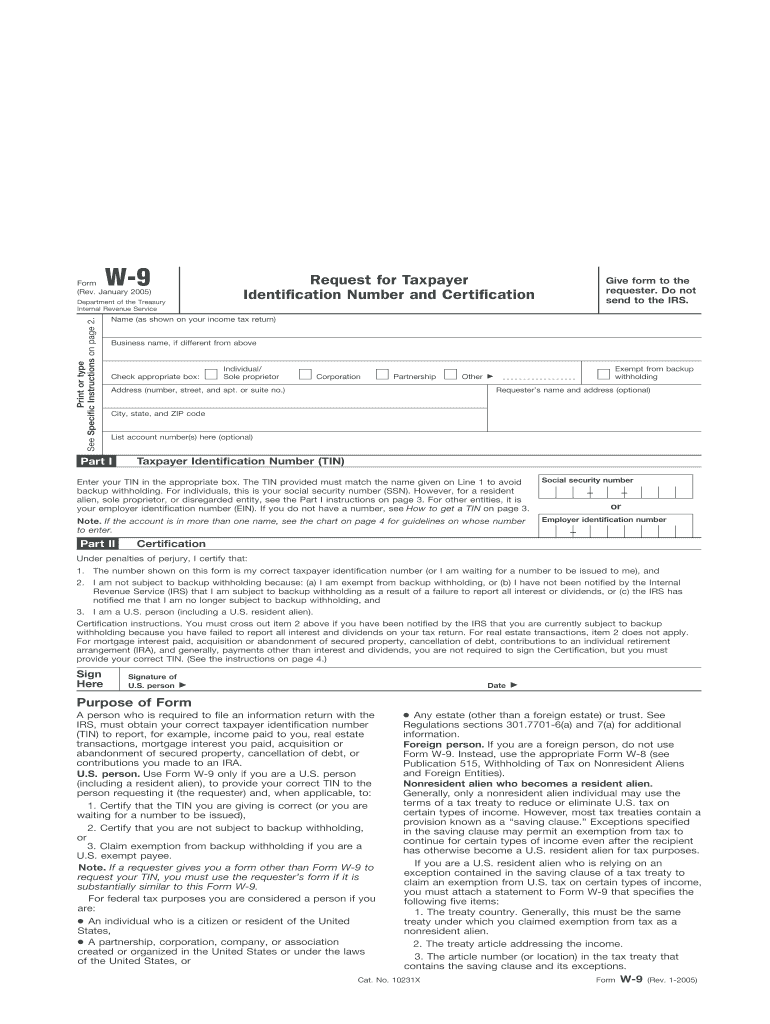

IRS W-9 2005 free printable template

Instructions and Help about IRS W-9

How to edit IRS W-9

How to fill out IRS W-9

About IRS W-9 2005 previous version

What is IRS W-9?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

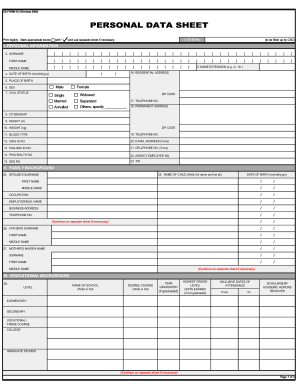

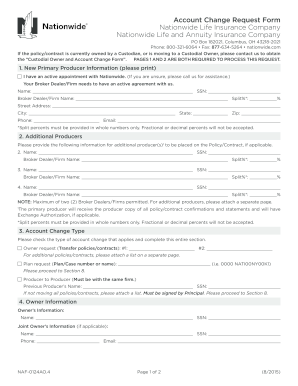

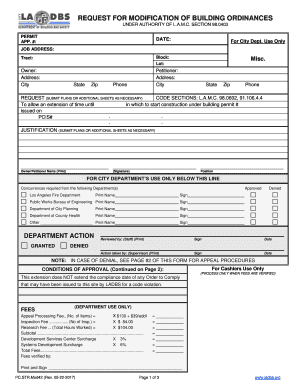

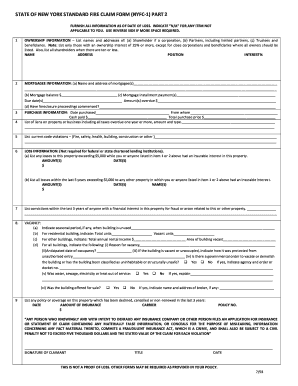

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS W-9

What should I do if I realize I've made an error on my IRS W-9 after submission?

If you discover an error on your submitted IRS W-9, the correct course of action is to submit a new form with the correct information. Ensure to clearly mark it as an amended W-9, and communicate the correction to the party requesting the form to avoid any confusion.

How can I verify that my IRS W-9 form has been processed by the recipient?

To verify the processing of your IRS W-9, you may need to reach out directly to the recipient who requested the form. They may provide confirmation once they have updated their records. Keep a copy of the submitted form and any communication for your records.

Are e-signatures accepted on the IRS W-9 form?

Yes, e-signatures are generally accepted on the IRS W-9, provided they comply with the relevant electronic signature laws. It’s important to confirm with the requesting entity if they accept e-signatures, as policies may vary between organizations.

What should I know about retaining records related to IRS W-9 submissions?

It is advised to keep a copy of your IRS W-9 form for at least four years after the tax return year you submitted it. This helps ensure that you can verify your information in case of any future inquiries or audits.

What can I do if I receive a notice from the IRS regarding my W-9 submission?

If you receive a notice from the IRS regarding your W-9, carefully read the instructions provided in the notice. Respond promptly with any requested information and keep documentation of your communications. Consider seeking professional tax advice if the matter is complex.

See what our users say